What is manager.one's Card-as-a-Service solution?

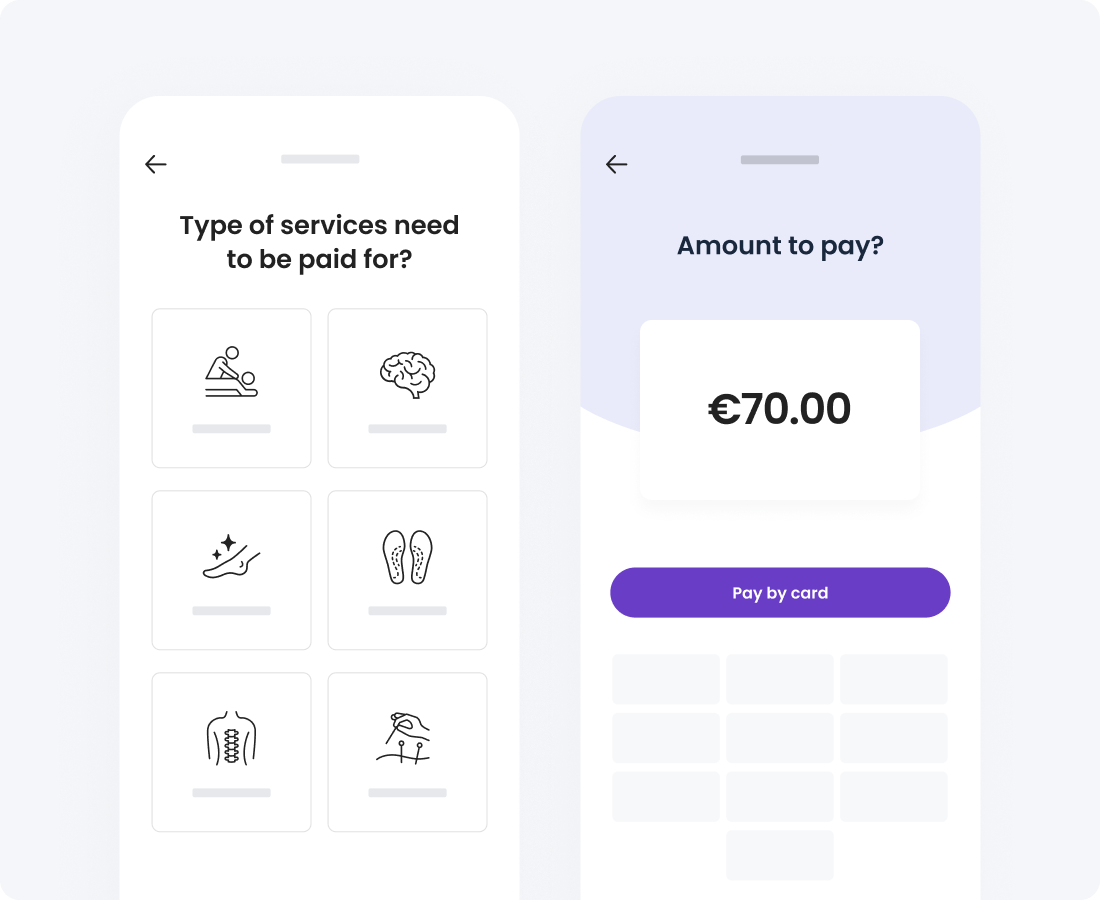

manager.one's Card-as-a-Service solution allows you to easily issue payment cards—both physical and virtual—in your branding for your clients, beneficiaries, or collaborators.

You set the usage rules (limits, spending categories, geographical zones...) and maintain complete control over each transaction.

Integrable via API or usable from our interface, it’s a turnkey solution for creating innovative payment experiences in sectors such as insurance, healthcare, travel, or mobility.