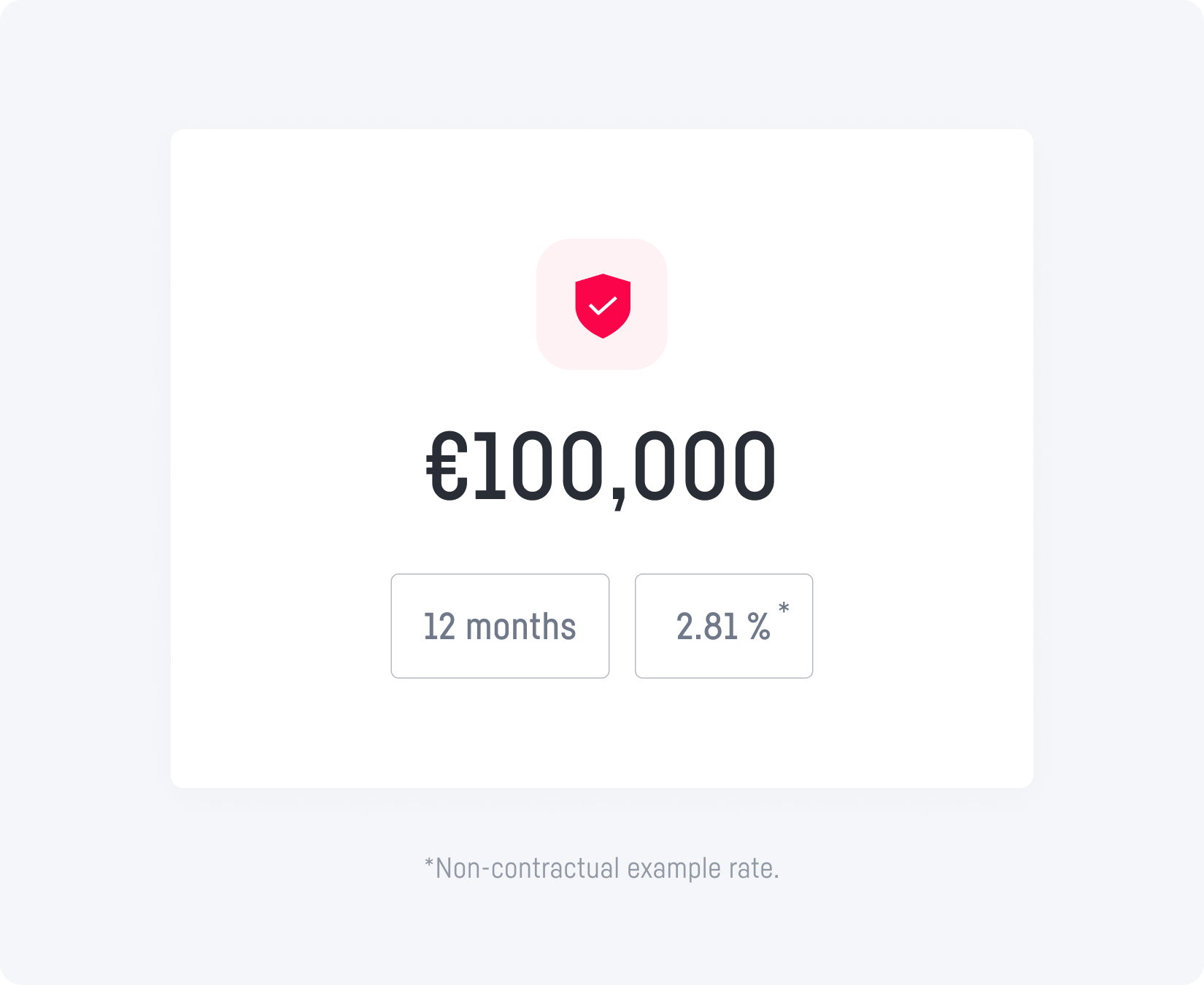

The operation of a business term account is simple. The company makes a one-off payment into the account, the amount of which is freely agreed between the company and the bank. The term of the investment is also freely determined, but is generally between 1 month and 5 years.

In return for this payment, the company receives interest at a predetermined rate. This rate is set by the bank and is generally higher than the interest rate on current accounts or traditional savings books.

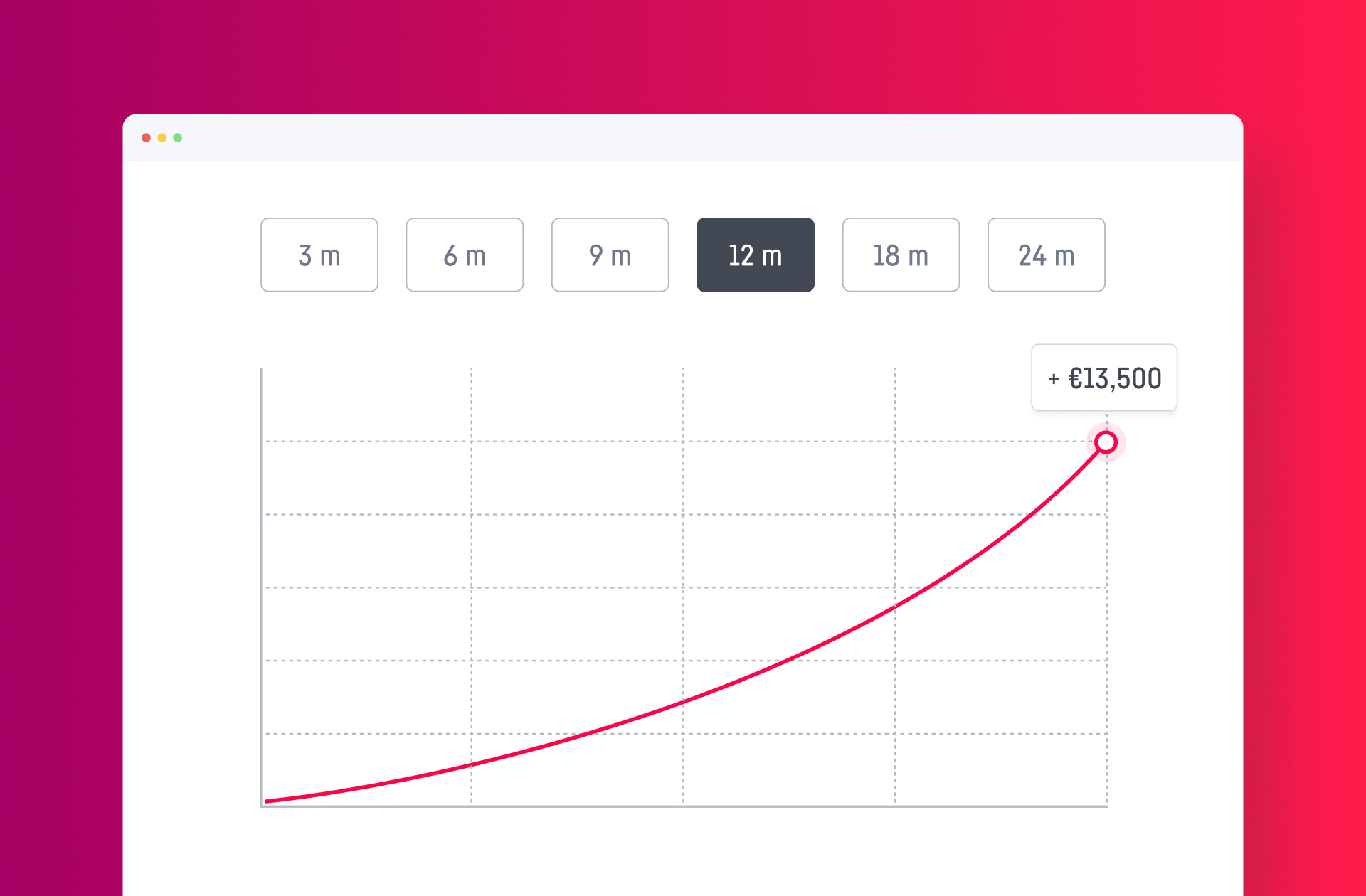

Interest is calculated on the basis of the capital paid in and the term of the investment. It is paid on maturity of the contract, i.e. at the end of the investment term.

Funds placed in a business term account are frozen for the entire term of the investment. However, you can request repayment before maturity at any time: you must give at least 32 days' notice of this request for early repayment, and the interest rate paid will be subject to a penalty that varies depending on the date of withdrawal, in accordance with the conditions set out in your contract at the time of subscription.